1. Net Sales

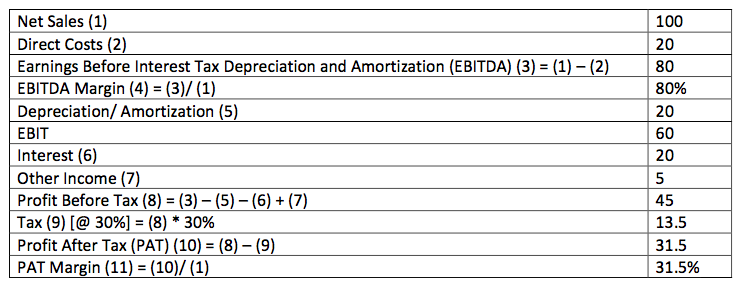

Given below is the most typical and simple structure of a P/L statement:

1. Net Sales:

This is the income which the company generates by selling its goods and services. All indirect taxes such as Excise Duty, Value Added Tax (VAT), Service Tax etc. have to be deducted from the Gross Sales to get the Net Sales figure as these taxes are collected by the business for the government and don’t belong to the business. From an analysis perspective, it is important to understand the contribution made by different segments and markets, the cyclicality of the sales revenues, and the management’s strategy to manage any risks to sales growth, such as new products, diversification into new markets, etc. Growth in sales must be analyzed to determine the contribution of increase in volume and/or increase in price.

In the above example, we have Net Sales of Rs. 100.