2. Direct Costs:

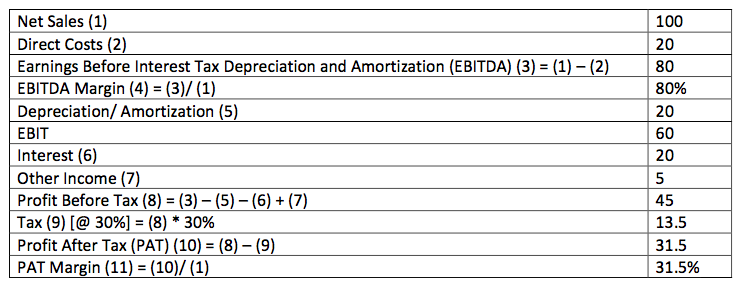

Given below is the most typical and simple structure of a P/L statement:

2. Direct Costs:

These are costs which can be attributed directly to business. Examples of these types of costs are raw material, salary, electrical costs, and others. Reducing operating costs will translate into higher profitability. Lower the direct costs, higher the operating efficiency of the firm. Costs may be variable, such as raw materials, semi-variable, such as employee costs or fixed, such as plant and machinery. Companies with high fixed costs can benefit from operating leverage. This is because an increase in sales can be made without taking on additional costs. In periods of growing sales such companies benefit from better profit margins. The cost structure of the companies also exposes them to risks when business slows down.

In the above example, we have Direct Costs of Rs. 20.