3. EBITDA (Earnings Before Interest Tax Depreciation and Amortisation)

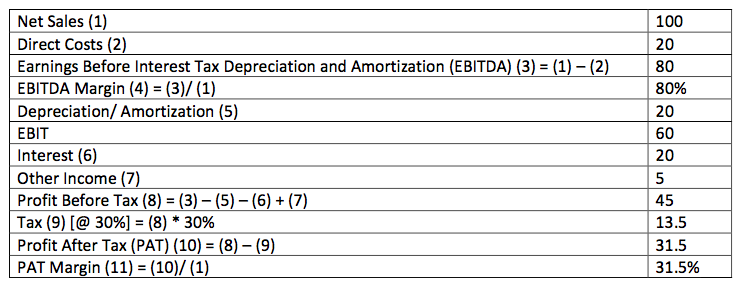

Given below is the most typical and simple structure of a P/L statement:

3. EBITDA (Earnings Before Interest Tax Depreciation and Amortisation)

This is the difference between Net Sales and Direct Costs. EBIDTA is a measure of the operating efficiency of the company. It enables comparison between companies that may have different capital structures, depreciation policies and tax rates. Higher the EBITDA, better the firm.

In the above example, EBITDA is Rs. 80, calculated as 100 (Net Sales) – 20 (Direct Costs).