5. Depreciation/Amortisation:

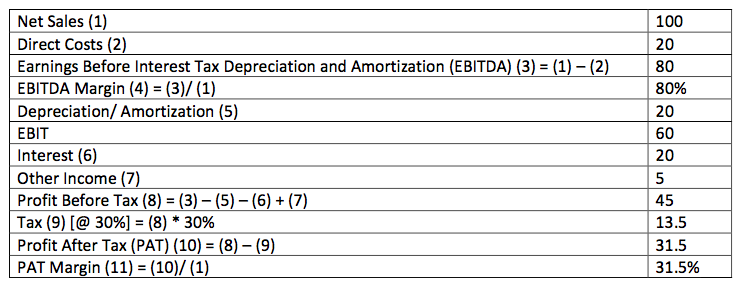

Given below is the most typical and simple structure of a P/L statement:

5. Depreciation/Amortisation:

Whenever a company purchases an asset, it is used for a long period of time and hence, it does not make sense to show entire expenditure at once in the P/L statement. In the above example, to sell goods worth Rs. 100, the company needs a machine which is worth Rs. 100. Now, if the company were to take a loan of Rs. 100 and purchase the machine and show it as expense in the first year itself, three problems arise:

* The company immediately goes into loss as income is Rs. 100 and expenditure would overshoot it.

* The machine would still be available for the company to use for future years but it cannot be shown as an asset.

* As the company would go into losses, it would not pay tax and that would result into loss of tax revenue for the Govt.

In order to prevent these anomalies from occurring, the expense of buying machine is divided into the estimated life of the asset (machine, in this case) and each year a part of the expense is shown in the P/L statement and remaining amount is kept with the company as an asset and is shown in the Asset portion of the balance sheet.

Amortisation is the term used for depreciation of intangible assets such as copyrights and brands. While depreciation or amortisation is shown as an expense in the P/L account, there is no actual cash outflow on account of this expense each year. The expense has been met upfront when the asset is bought.

In our example, each year the company would show Rs. 20 as expense and correspondingly reduce the Asset by that much amount, so that in 5 years the entire machine would be ‘consumed’.