(d) Long Term Debt:

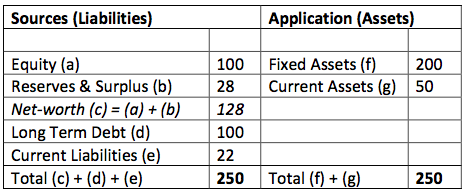

Given below is a sample balance sheet:

(d) Long Term Debt:

Any debt taken for a period of more than 1 year is considered to be non-current liability or a long term loan. This may be in the form of term loans taken from financial institutions or debt securities issued such as debentures. Investors prefer companies with low liabilities. However, the nature of the business and the lifecycle of the company may dictate the level of debt in the balance sheet.

Industries such as IT, education, Business Process Outsourcing (BPO) etc. do not require huge investments either in capital assets or for procuring raw materials and other expenses. Hence, such sectors generally exhibit a balance sheet which has very low long term debt. In case a company has high debt in this sector, it would generally be temporary for expansion purpose when the company is in the growth stage. Companies in the banking and non-banking space cannot be analyzed on this parameter as their business requires them to garner long term deposits, which are then disbursed as loans.

Heavy capital goods based manufacturing companies need to have a judicious mix of debt and equity, depending upon project at hand, type of industry, interest rates, etc.

Classic examples of companies losing investors’ interest due to high debt are Suzlon, Bhushan Steel, HCC and Kingfisher. Wockhardt is an example of a company which was heavily under debt but managed a turnaround.

In the above example, Long Term Debt is Rs. 100.